Getting started is quick and easy

Register Yourself

Verify PAN

Fetch Data

Benefits of Avanza for

Tax Professionals and Businesses

Time-Saving Automation

With a one-time PAN-based login, Avanza.tax fetches and syncs all required tax data (GST, ITR, TDS) in one go, allowing you to focus on higher-value tasks.

Organized Data Management

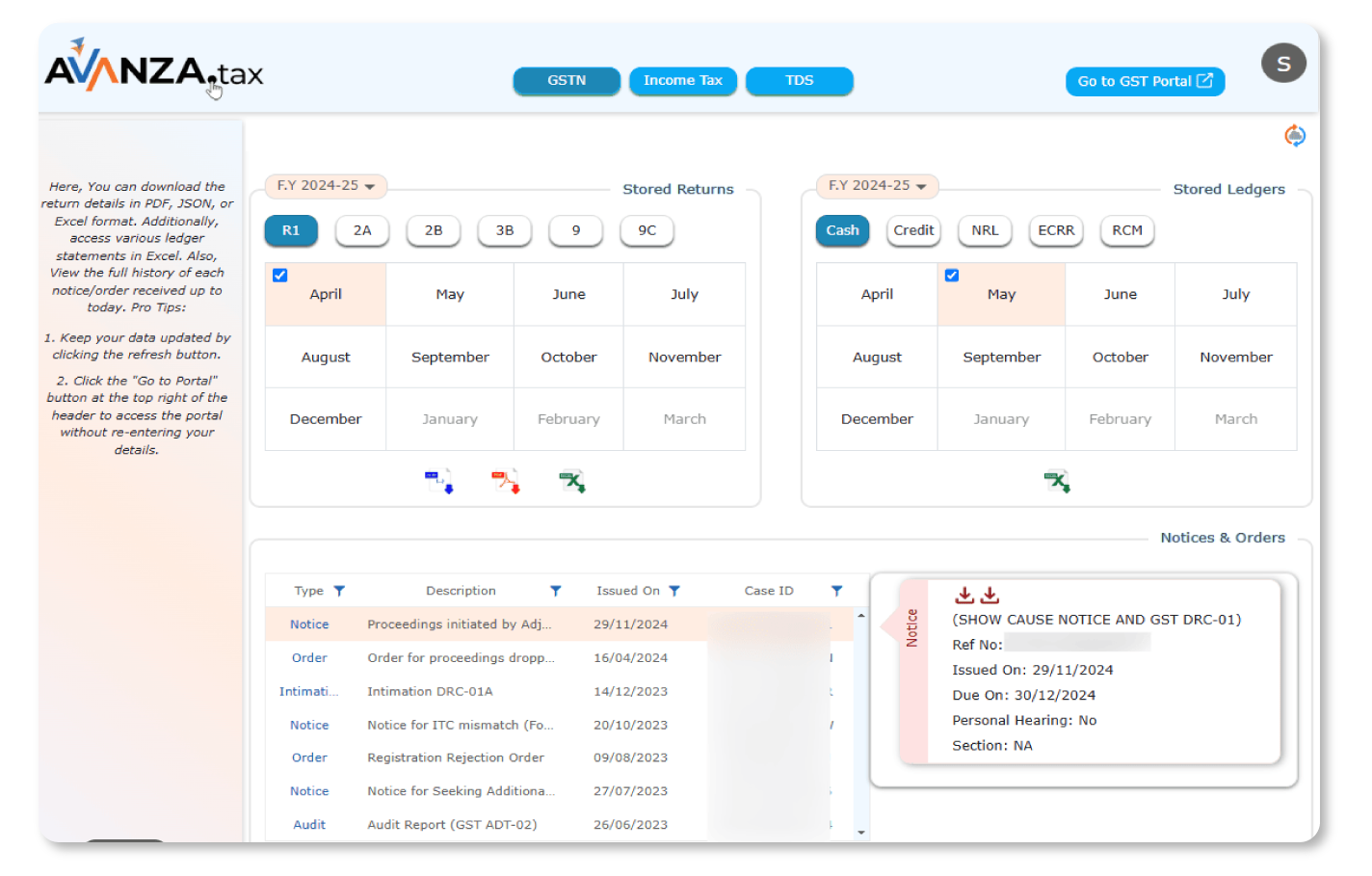

No more switching between different portals to access client data. Everything you need is neatly organized and easily accessible in one dashboard.

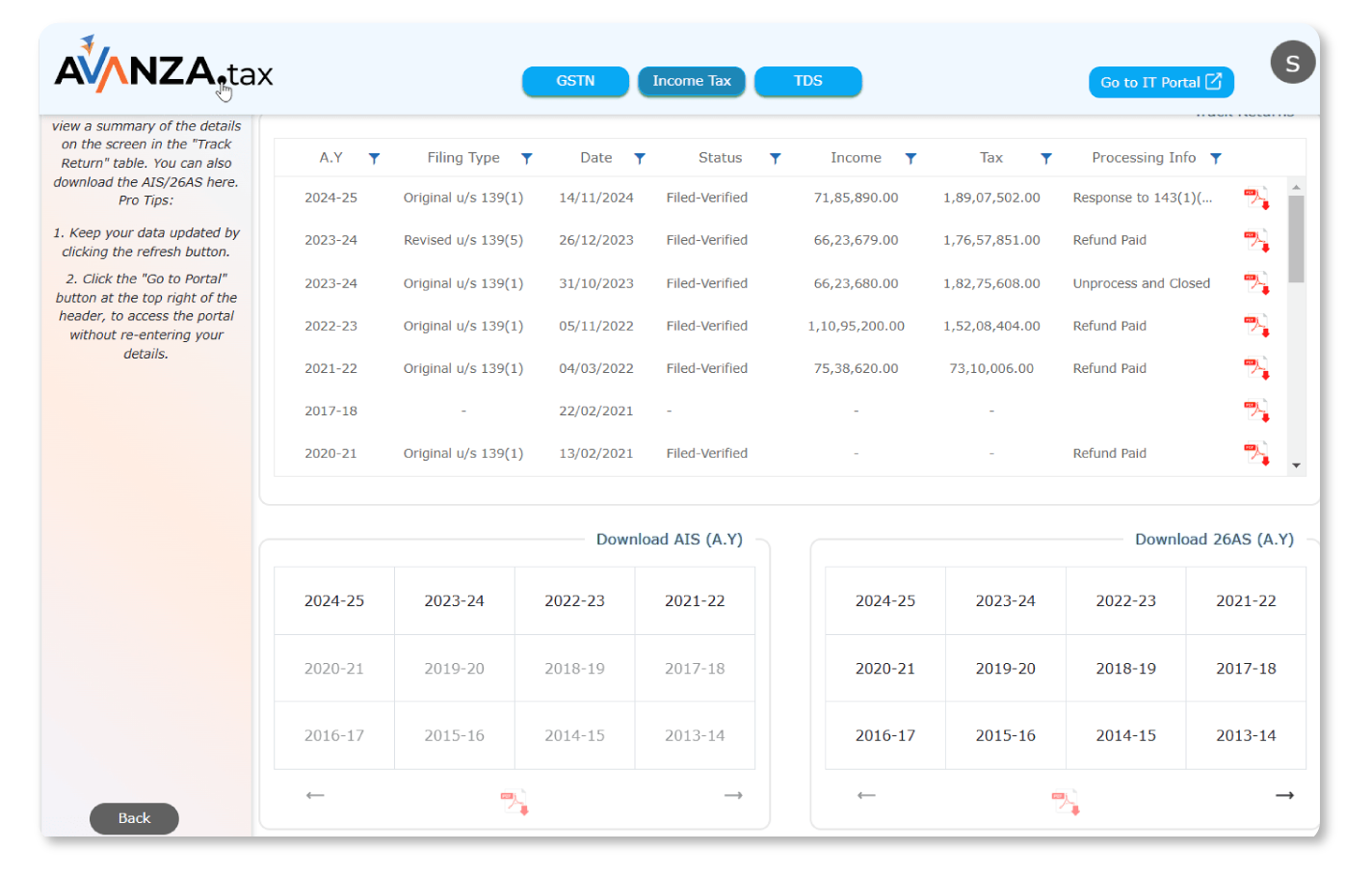

Real-Time Data Syncing

Always have the latest tax information available, from filed ITRs to pending refunds, eliminating the risk of outdated data and ensuring you are always on top of compliance.

Enhanced Client Management

Whether you manage individual clients or large businesses, Avanza.tax provides a clear and comprehensive view of each client’s tax status, notices, and filings.

Complete Historical Data Access

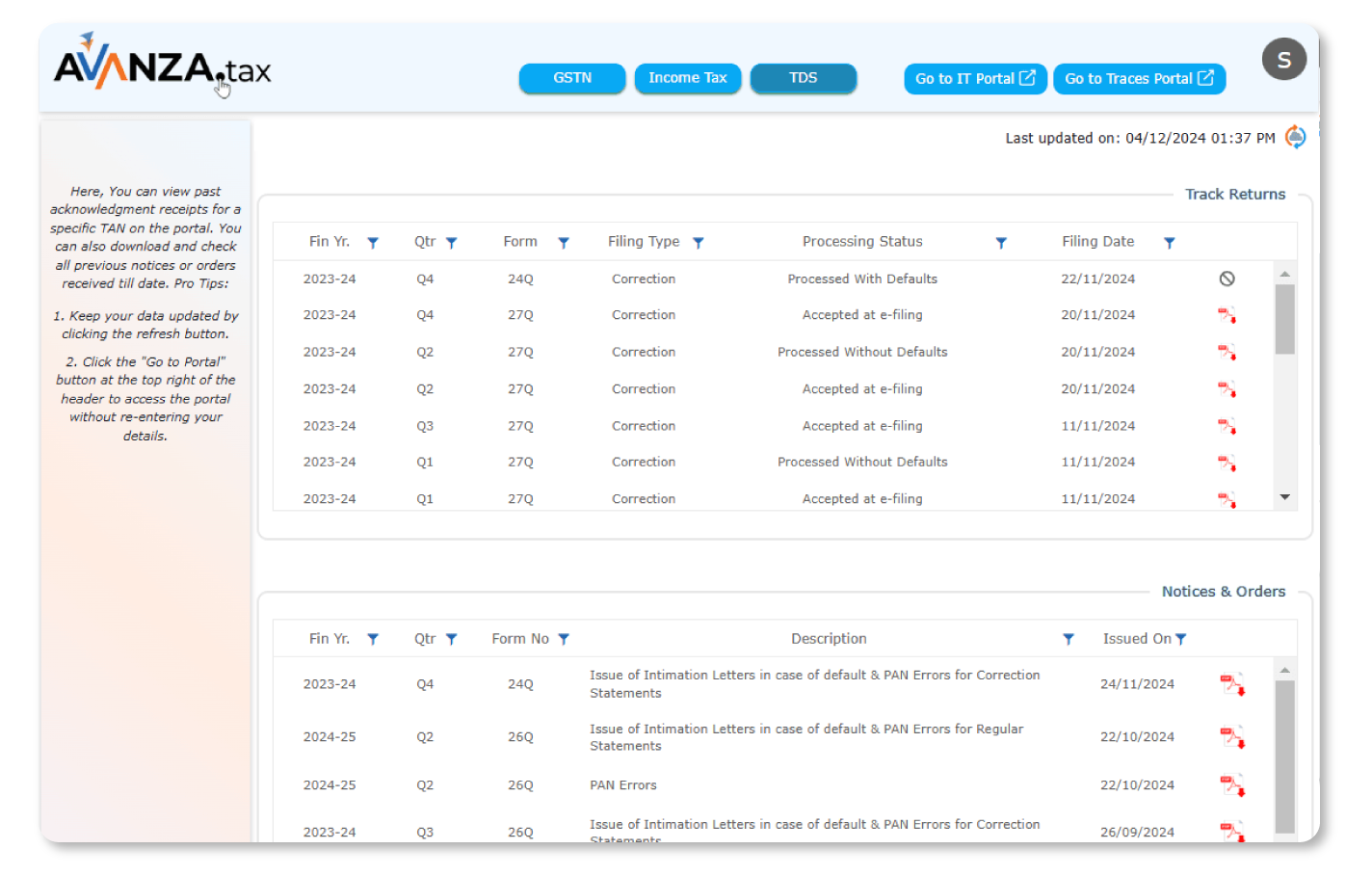

With access to all filed ITRs, TDS data, and GST returns, you have a complete historical record for audits, reviews, and client inquiries.

Audit-Ready at All Times

Avanza.tax helps you track notices, responses, refunds, and more in real time, making sure you stay on top of your clients’ compliance and audit needs.

Easy-to-Use Interface

With minimal training required, Avanza.tax makes data retrieval, syncing, and reporting simple and efficient, letting you work smarter, not harder.

Scalable for Growing Practices

Whether you’re managing a few clients or dozens, Avanza.tax allows you to scale up.

Complete Notice Management

Track notices and stay ahead with a full correspondence trail.

Frequently Asked questions

- JSON

- Excel

- Bank-Grade Encryption:

We are 128-bit SSL certified, so data is protected during transfer and storage from unauthorized access. - Secure Cloud Backup:

Keeps data accessible anytime and anywhere, safeguarding against hardware failures and cyber incidents. - Data Privacy Compliance:

Adheres to stringent privacy and confidentiality regulations, protecting your data's sensitive nature.

- Register on our platform.

- Use your PAN for a one-time setup to fetch tax data from the GST, TDS, and ITR portals.

- Start managing your tax records instantly.

- View the complete notice history for each client.

- Track correspondence and response timelines.

- Organize notices based on PAN, TAN, or GSTIN.